Times were different when I did my initial round of competitive research for my first business. Back then I actually utilized the yellow pages to look for local competitors! I also thought that my business reach was measured in miles from my office location. (Oh was I wrong about that!)

From my very first business plan in the late 90’s:

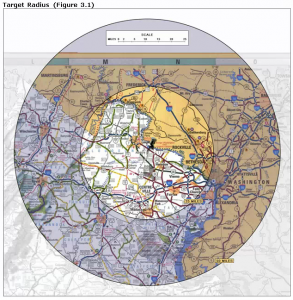

“We currently have a handful of clients in Northern Virginia and Southwest Virginia. To obtain new business, we will target local, non-franchised, for profit and non-profit small businesses as well as individual consultants and professionals. Specific areas targeted will include Ashburn, VA and in areas radiating 25 miles from our business location.”

I even had a map showing the cities within 25 miles and cities within 50 miles which made up my “target market”.

It didn’t take me long to realize this approach was ALL WRONG! Even back then the Internet was creating the ability for local businesses to compete on a global scale. My “locally targeted” business ended up with customers in Arizona, California, Illinois, Maryland, Nevada, Pennsylvania, Virginia, Washington DC, and El Salvador. This time around, I’m skipping the phone book and ignoring anything relating to my physical location.

Why do competitive research?

Everyone has competition. Literally everyone. It might be direct competition (where another company is selling the same thing you’re selling) or indirect competition (where they are selling something related, similar, or a substitute). Either way, you’re likely competing in similar markets or even for the same pool of money. Knowing who your competitors are and what they are up to will help you understand your market, the needs and expectations of your customers, how to price your products or services, and how to target customers and reach new ones. Research will help you duplicate success and avoid failure. This research is not a one time activity; it’s something you need to do periodically as the market changes and as competitors enter and leave the picture. Luckily, there are now a myriad of free or low cost online tools to help and give you unprecedented competitor insight. (See list below.) There are of course research firms that can assist you, but first, why not see what you can learn on your own?

Competitors are Friends not Enemies

Competitors are nothing to be afraid of. In fact, they can turn out to be your biggest supporters and even a source of business and useful information! Think about it. These folks know about the industry, have the contacts, and have likely already overcome the obstacles you will likely face. That’s an easily accessible knowledge source or potential mentor.

When I was getting my first business started, I thought in addition to providing web development services, I also wanted to have a web hosting facility. I was introduced to the owner of a local hosting company at a Chamber event. He invited me to take a tour of his facility. The tour was fantastic fun but also totally eye opening. I saw immediately that running a data center was way more involved that I had considered. That “competitor” introduction ended up helping me focus on the intended core web development path. Believe it or not, many clients were referred to my company by other “competitors.” If a customer wasn’t a fit for the competitor or they were just plain busy at the moment, they needed a place to send that customer to. In other cases, competitors outsourced project work to us or partnered with us (transparently or behind the scenes.) In one case, a partner actually made business cards for us with their company name on them, so when we met with their clients, we appeared as one team. On the flip side, customers would come to us with a specific technology or service need that wasn’t our specialty. Other times the customer just didn’t have the budget for our services. I often referred those customers to smaller shops that I trusted to do a good job. (A good or bad referral is a reflection on your company’s reputation too!)

If I had never cultivated relationships with competitors, I would have missed out on valuable referrals, relationships, and paying work! Even now, many years later, those relationships will serve as a starting audience for this new business. Need more “make friends” convincing? See Inc Magazine’s “Let’s Be Friends” article.

Competitive Research Framework

First, determine how you define your direct competition and indirect competition. What kinds of companies would quality as competitors? If you are already aware of some market players, write those company names down. Next, jot down a list of the key phrases an end customer would use to search for your product or service. Example: For my new business, (providing “done for you” business templates and worksheets for a number of industries), a good direct search term is “web development business templates” or for indirect, “business templates” (A bad (not properly targeted) phrase is “web development templates.” In a web search, the absence of the word “business” results in graphical and HTML web site design templates – which is not at all what I’m selling.) Use your list of 5-10 key phrases to find websites for competing businesses.

Once you’ve established a hearty a list of competitors (and determined each is indeed a competitor), it’s time to learn more about each. Start by compiling a standard set of information about each company.

For each company, research and record the following information:

- Company Name

- URL (www.companyname.com)

- Competitor Type (Direct or Indirect?)

- Company Opening Year

- Check the website’s “about us” page, check incorporation filing records, or alternatively, when the domain was first registered.

- If they have a Facebook company page, this info is likely available in the timeline feature.

- List of Products or Services (including Pricing)

- Ranking

- How closely to watch this business.

- Ex: 3 = “Regularly”, 2 = “Periodically”, 1 = “Seldomly”

- Any other info you are specifically interested in.

- Examples: What kinds of customer support do they provide? What feeling does the website give the end customer? What writing style is used to communicate with the end customer? Etc, etc, etc.

For each website, take a screenshot of the home page, and other pages that contain information you might want to reference later. (Website content changes all the time. Don’t assume the content you were interested in will be there next time you visit!)

Now that you have the basic information, it’s time to dig deeper. There are a number of ways to learn more about your competition. Again, the best way really is to introduce yourself. You’ll learn and gain more from forming a business relationship, rather than just “mystery shopping” them. Set the tone properly in the beginning by making it clear that you are in a similar industry. Be upfront that you are researching the industry and are interested in starting a business. Network with them, visit their booth at industry event, or reach out via LinkedIn or a similar industry network. Ask them for an information interview where you can learn more about them and their business. Find out what they look for in a partner. (That partner could be you in the future!) If you have the opportunity, talk with their customers or suppliers. Hire them or buy one of their products. (There is a lot to learn from experiencing their purchasing and fulfillment process.) Ultimately, you want to get a sense of their strengths and weaknesses, their competitive advantages over their competition, and any key brand differentiators.

Other Online Research Tools and Methods

There are a number of free ways or inexpensive tools to aid you in learning about competitors as well as keeping up with their successes over time. Here are a few:

- Subscribe to competitors’ email newsletters (or RSS feed)

- Subscribe to Twitter feeds and pages on Facebook and LinkedIn

- Subscribe to keyword alerts

- Get an email when certain phrases show up online. Three easy to use services are Google Alerts, Yahoo Alerts, and Twilert (for Twitter).

Online information sources and miscellaneous tools. (Enter your competitor’s site and compare it to your own!)

- Social Mention – Search posts, videos, and online mentions for a brand. (Also create brand keyword alerts.)

- Wikipedia – Look for competitor informational pages.

- Compete.com, Alexa, Quantcast – Website analytics, audience, and site traffic analysis.

- Hoovers, Dun & Bradstreet – Search global business records and information.

- NameChk – Check a username or vanity url at dozens of popular Social Networking and Social Bookmarking websites. (i.e.: See what social networks competitors are using. Also check to see if your “brand username” is available.)

- Google Trends – Compare search traffic for two topics. (Ex: Type “Coke, Pepsi” to compare one soda company against the other.)

- Wappalyzer – A browser extension that uncovers technologies used on websites. Detects what content management systems, web shops, and other online tools your competitors are using.

- KeywordSpy, SpyFu – Insite into a website’s keywords and ad spending.

Please note: While some of the tools above touch on keywords and online search, the intent at this stage is less about SEO (search engine optimization) and more about getting acquainted with competition websites. (SEO research is a sizeable topic for another day.)

Put “How to Conduct Competitive Research” to Use:

Here’s the part of the article where I have to do the work I’ve suggested myself. Rather than post my competition research, I’m going to compile it offline. It’s no big secret and all the info obtained is public, but I’d rather not post it here at this early business stage.

Homework:

- Determine what kinds of companies would quality as your direct or indirect competition. Make a list of any company names you’re already aware of.

- Create a list of key phrases an end customer would use to search for your product or service. Use this list and a search engine to uncover additional competitors.

- Research each company individually, compiling a standard set of comparative information.