Now that you’ve decided on a trademarkable name and have secured a coinciding or smart domain name, your next most important decision is your business operating entity type. While you can certainly change entity types later, it pays in time, effort, filing fees, and in tax implications to do this right the first time. Choosing a good name and creating your LLC before you start opening business accounts will save you the trouble of having to update your listed final (and legal) company name with all your vendors.

There are 5 types of entities and each has distinct benefits and considerations. Many small businesses start out as either a Sole Proprietorship or a Limited Liability Company. These are the easiest and most straightforward to form. In fact, to form a Sole Proprietorship there’s nothing you need to do at all; this type is formed by default if you don’t file for any other entity type. It simply means that you are the owner of a company made up of one person.

It is very tempting to “do nothing” and opperate as a default Sole Proprietorship. A word of caution however: A Sole Proprietorship does nothing to distinguish yourself from your business. If your business gets sued it means you personally get sued as well! To better protect yourself, the next easiest entity is the Limited Liability Company (LLC.) The LLC gives you personal protection from debts, claims and liabilities. (Not to say that you still couldn’t get sued personally, for egregious errors, personal negligence, etc, but with an LLC you have an extra layer of legal protection.)

Please note: No form of business entity can insulate you from a personal loan you take out on behalf of the business. That loan will be yours to pay, regardless of the existence, success, or failure of the business.

Like a Sole Proprietorship, the business profits or losses are recorded on your individual tax return (with what’s called a “Schedule C”). From an IRS perspective, an LLC is the same as a Sole Proprietorship. This makes tax filing easier, in contrast to other business entity types, which are taxed separately. LLCs are good for small companies (including companies of one). They are a good first step to a potential future formation of a more complicated entity, like an S Corporation or C Corporation. (Think stocks and shareholders.)

Everything you need to know about an LLC is expertly detailed in the book Form Your Own Limited Liability Company

from Nolo. I highly recommend using this reference to help you understand the choices and make an informed decision. (Particularly helpful is the entity comparison chart, in Chapter 1.)

How to File

The are a number of ways you can form an LLC. You can hire a company that specializes in entity formation, you can hire a lawyer to file for you, or you can complete and submit the form yourself. Filing for an LLC is easy. All you need to do is complete a paper or online form (called the Articles of Organization) and submit a payment for the filing fee. (Nolo maintains a free and awesome list of what’s needed in each state, including where to file.) For multi-member LLCs, it is also recommended that you create an Operating Agreement, that spells out how decisions will be made, how money flows, and the rights and responsibilities of all members. (Without an Operating Agreement, the laws of your LLC registration state will prevail.)

As discussed in the Name the Thing article, you’ll need to make sure your name is unique and hasn’t already been registered as an LLC or trademarked. (Each state will have their own corporation records database.) Your LLC name (final company name) must contain a designator, signifying the LLC entity type. As such, you’ll commonly see a company name format like: Consulting Company, LLC. Check with your filing state for the specific naming requirements. (Some specific abbreviations and formats are available or even required in some states.)

After Setup

Now that your entity is set up, you’re ready to take your LLC certificate to a bank. Regardless of the entry type you choose, I highly recommend setting up a separate bank account that you use only for business purposes. (This is required for all entity types expect Sole Proprietorship.) A separate account will help you in your expense accounting and when you’re filing your year end taxes. You’ll want to sign all documents and contracts in the name of the LLC (rather than in only your personal name.) For example: Consulting Company, LLC, John Smith, LLC Member.

Put “Entity Formation: To LLC or not to LLC” to Use:

The last company I built was an LLC, so for me, the choice is easy. I’m going “LLC” again. While I don’t expect this new company to be as large or even as open to risk as the last company, I just feel better with the level of protection (and professionalism) that an LLC brings.

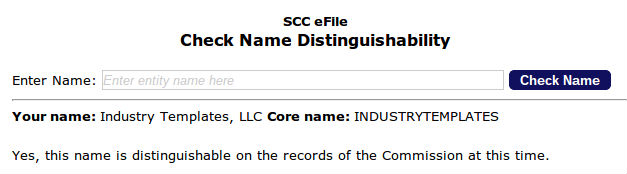

I live in Virginia (USA), so that’s the state I feel most comfortable filing in. The first thing I did was check Nolo’s Virginia cheat sheet. Next, I re-read all the parts I originally highlighted in my copy of the Form Your Own Limited Liability Company book. (Yes, I had kept it and I’m sure glad I did!) Next, I did a search of the Virginia LLC Name Availability Database. Success!

Successful Search Result for a Distinguishable LLC Name

I then completed the Virginia LLC online formation wizard and submitted my online formation payment, which was $100. Completing the application was easy. It took me approximately 10 minutes from start to finish. Neat fact: I actually completed the filling process in the middle of the Atlantic Ocean, just off the coast of Florida. (I filed while on a cruise ship!)

The LLC was effective immediately. I downloaded my LLC receipt, payment receipt, and the needed Articles of Organization.

If you search the Virginia LLC Name Availability Database for the phrase “industry templates” today, you’ll see there’s a conflict. The error says “Name is not distinguishable.” and that’s because that name is now registered and tied to my business!

Right after entity formation, I applied for an EIN (Employer Identification Number or Federal Tax Identification Number) which identifies a business to the IRS (Internal Revenue Service.) Every new business needs one, and certain vendors (like your bank) will ask for it when creating accounts for you. This application can be completed entirely online, is free, and will take you less than 5 minutes to complete.

Finally, I downloaded a business account application form from my bank’s website. I was sure to include my legal company name (Industry Templates, LLC) and sign the form as a member of the LLC (which included my name along with the business name as discussed above.) After a quick trip to the bank, my business checking and savings account was created. I made sure to bring all the needed documentation with me, which included my drivers license, Articles of Organization, and the EIN letter provided by the IRS.

Entity Formation Checklist

Complete the following to create an LLC and also show intent to separate your personal assets from your business assets.

| Action | Me | You |

| File Articles of Organization and pay the filing fee. | ✓ | ? |

| Draft an Operating Agreement, signed by each member, showing ownership percentage. If you have multiple members, also hold and document an initial organizational meeting. | ✓ | ? |

| Obtain an EIN (Employer Identification Number) from the IRS. | ✓ | ? |

| Open a bank account for the business | ✓ | ? |

Homework:

- Research the different business entity types and decide which is right for you. Seek legal or tax advice where needed.

- Review Nolo’s formation cheat sheet for your state.

- Search your state’s corporation records database to make sure your final legal business name (with “LLC” designation) is available.

- Complete the actions in the Entity Formation Checklist above.